Organizations usually face a challenge, determining what will be the contribution of the strategies to be implemented and how they will impact their results. In other words, What is the Total Cost of Ownership (TCO)?

Savings obtained by companies that apply strategic supply are between 5% and 20% of total spending. And this is not all, a reference that is an overwhelming argument is that “$ 1 saved equals $ 6.75 in sales revenue” as indicated by Purchasing and Procurement Center in its publication “Strategies, Examples & Techniques That Show How To Achieve Cost Reduction In Purchasing”

On this matter, strategic sourcing strategies, from their conception, provide a vision focused on quantifying the benefit and measuring the contribution.

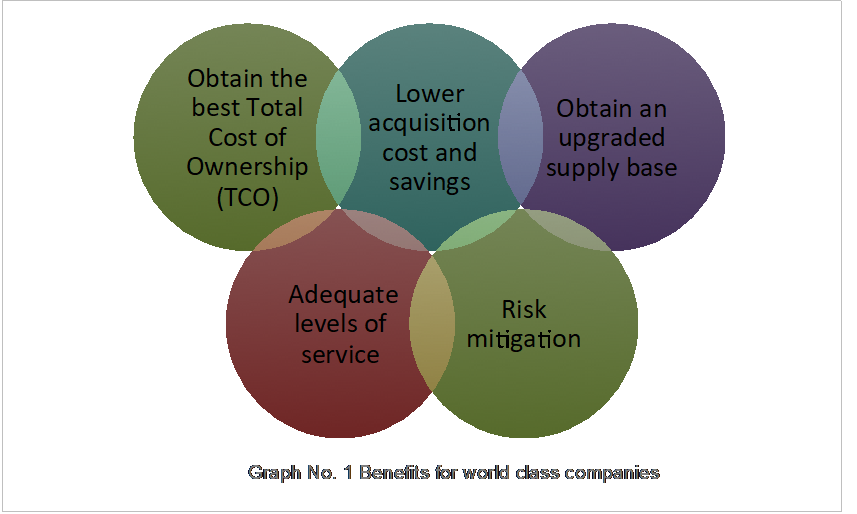

Although benefits are obtained in different fields, world-class companies obtain mainly the following:

The big difference, Strategic Sourcing focus on the Total Cost of Ownership (TCO)

Before you dive into this blog, you can also have a look at our extensive course on Total Cost to Ownership & Serve, where SCMDOJO Expert Corey Weekes have explained in detail Total Cost of Ownership Definition, Key Considerations, The Green Economy Impact, Post Covid Supply Chain Realities and Cost Calculation Checklist

What is the Total Cost of Ownership (TCO)

TCO is one of the pillars of strategic sourcing, which is one of the main differences compared to the traditional purchasing approach.

“Total Cost of Ownership can be defined as all the payments and/or expenses that an entity incurred to use and maintain the good or service during the useful life or the time required under proper conditions”

One way to facilitate an understanding of the Total cost of Ownership (TCO) is to compare it with the concept of price.

Price is the amount of money that an entity, person or company, pays to acquire goods or services.

“The initial cost of acquiring the product can be relatively small compared to the set of elements required throughout its useful life”

Jimmy Anklesaria in In his book, The Supply Chain Cost Management: The Aim Process for Achieving Extraordinary Results, he defines

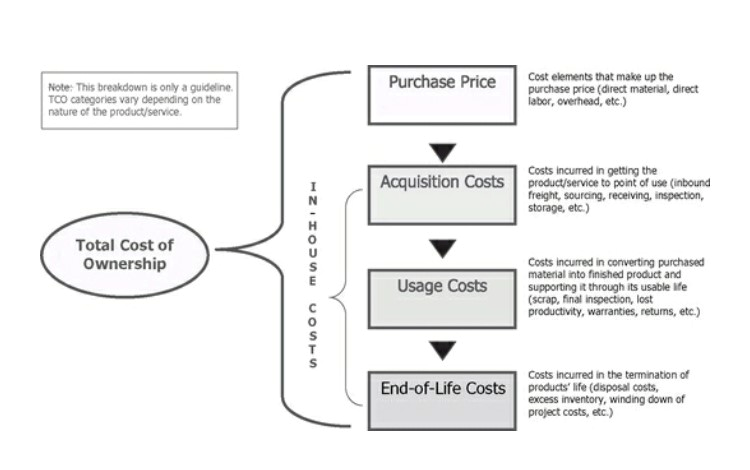

“The Total Cost of Ownership (TCO) is the present value of all cost incurred during the life of a product or service” and presents a figure that illustrates the type of cost elements in each of the TCO categories. Below you can find the image taken from the book.

“Example of cost elements in the Total Cost of Ownership”

There it is also mentioned that “It is hard to calculate some of the costs in the Total Cost of Ownership model “and the main reason for not estimating it is the lack of information”, Most often, a customer has poor or non-existent data on the cost of receiving, inspection, storage, handling, scrap, warranties, field service, lost productivity or lost sales, outbound logistics, customer returns, and end-of-life costs. So, it is easier to focus on the supplier’s price. That is a big mistake. Not that supplier’s price is not important. It’s just that there are so many opportunities when one looks internally as well ”

Additionally, it only considered the specific requirement that has been received, isolated from its environments, such as supplies, insurance, maintenance, goods or complimentary services so that the need is met, including stripping costs.

In some cases, the initial cost of acquiring the product can be relatively small compared to the set of elements required throughout its useful life and can make a significant difference in the decision-making process to do the best business.

When Total Cost of Ownership (TCO) is taken into account, a comprehensive evaluation is being achieved that directly impacts the results in the selection of suppliers, the prioritization of the acquisition of capital, the corporate budget, allowing the acquisition costs to be in line with the strategy of the business.

This concept is applicable in all purchasing categories and in all areas and industries, for example in technology acquisitions, Gartner defines the Total Cost of Ownership (TCO) as

“a comprehensive assessment of information technology (IT), Other costs across company boundaries over time For IT, TCO includes procurement, administration and support of hardware and software, communications, end-user expenses, the opportunity cost of downtime, training and other productivity losses. ”

Considerations for Calculating Total Cost of Ownership (TCO)

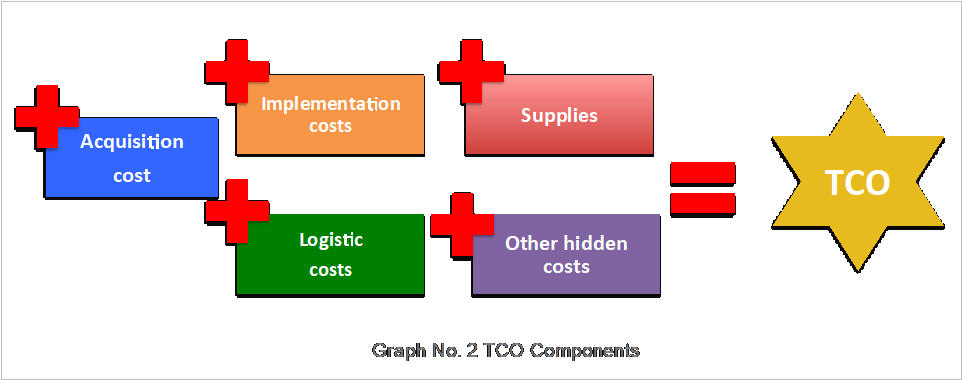

The main reflection to be made by the person in charge of the acquisition process is that the acquisition cost is not the only element that must be incorporated in the evaluation for the selection of the best alternative. There are factors such as performance, implementation costs, logistics costs and other hidden costs that, when considered, could drastically change the decision by having more elements that allow an informed decision to be made and an adequate selection.

Next, I want to illustrate some factors that are not so evident and that must be considered for the correct calculation of the TCO:

- Indirect costs: consumables, additional software licenses to those provided by default, training to operate or use it, extended warranties, replacement of complementary goods or services or that have interaction with the good to be purchased because they are not compatible.

- Logistics costs: transportation or freight of the goods, installation costs, staff travel fees, temporary storage. The availability of spare parts should also be considered as adequate, in terms of quantity and delivery time. If you do not have it, there may be additional costs to have the parts in a reasonable time, since you can stop production processes that are very expensive to stop.

- Expansion costs: In some cases, there are acquisitions that have limited capacity, and in the event that there is a probability of requiring an expansion in the short or medium term, the possible scenarios should be evaluated, since it could mark the selection among the offers from different providers. It not only covers more capacity, but additional accesses in the case of a software package for users in the future.

- Financial costs: Some of the possible costs to consider financial are financing that can affect the total cost of ownership, in case the company must obtain resources for the acquisition. Accounting policy and possible deductions in terms of taxes. In this section it is key to work as a team with the finance area to ensure you have a complete overview of their respective acquisition-related implications.

- Labor costs: It must be taken into account if the acquisition should require additional labor costs, for example, I will acquire software that requires you to incorporate an expert in the administration of this software in the payroll.

- Dismantling or final disposal costs: In some cases, it is necessary to consider what is the cost of dismantling or dismantling the property, as well as what is necessary to comply with the legal and environmental requirements in terms of final disposal of waste. It is not always as simple as throwing it away, sometimes complex and expensive processes must be carried out. In addition to these, it must be taken into account if there is information that must be migrated for a future change and the costs that this entails.

Several of the aspects mentioned above have been part of a learning process of many years, some of them taught by managers, colleagues and even suppliers, and others that in the development of projects with detailed and rigorous analysis have come to light, allowing make the best decisions.

With everything described above, it can be seen that the big difference between Strategic sourcing and conventional purchasing management is the focus on the Total Cost of Ownership (TCO).

29 Best Supply Chain Resources & Tools That Help You Learn & Grow

Lower Cost of Acquisition

One of the benefits for organizations that implement the strategic sourcing methodology is obtaining lower acquisition costs, either because better prices are renegotiated with current suppliers or new suppliers are found through market intelligence, they are identified substitute goods or services.

The main levers that are used to achieve these objectives are the aggregation of demand, the rationalization of suppliers, long-term contracting and the revision of the specifications adjusting the quality to the purpose.

This is an item that must be permanently reviewed and that must be complemented with the administration of contracts to verify that the added value that has been incorporated through the implementation of the best strategic sourcing practices.

Upgraded Supply Base

In the search for the best alternative to meet the need, it is possible to find supplies of better specifications in terms of performance and cost than those commonly used, and that of course are fully compatible. This is due to the progress that manufacturers make in their continuous improvement processes, and that by doing adequate research they can be identified.

We can also find that to various existing or new suppliers they have other goods in their catalog that may be interesting for future purchasing processes, therefore, as it is colloquially said, you should have your eyes wide open.

Adequate Level of Service

One of the aspects that are reviewed throughout the supply process is the service level that the company requires to satisfy the needs.

It should be used once a review, market intelligence and negotiation process is started to incorporate service levels, both for the delivery of goods and for the supply of services. Being important that they are adjusted to the needs, it is as bad to have some oversized levels as the undersized ones, in one case because the expense can be increased unnecessarily or because the commitments acquired within the companies or with third parties are not fulfilled.

Mitigation of Risk

Last but not least, risk mitigation is an issue that also faces. Organizations are exposed to different supply risks, such as: poor quality, abrupt price increases, information security failures, inadequate supplier practices, lack of contingency plan and business continuity of suppliers, lost the know how acquired among others

In this regard, a detailed analysis of the possible adverse effects that may occur and possible alternatives that mitigate the risk must be carried out in each case, which in most cases is a standard that world-class providers comply with. The important thing is that they are requested at the appropriate time of the negotiation so that they can be included without adding cost for this.

Finally, to close our article and before concluding, it is worth remembering why companies are interested in strategic sourcing, and as stated by Michigan State University in their article

“Why Companies Should Consider Strategic Sourcing … In today’s competitive business climate, supply chain management professionals are constantly seeking out creative ways to reduce costs, assure and improve the quality of the final product and achieve a faster time to market. Strategic sourcing is one method that procurement managers can use to help achieve these supply chain goals. ”

Conclusion

Significant outcomes can be achieved if different fronts within the Strategic Sourcing and Procurement process are carried out, different considerations and key factors that allow the person in charge to make an informed decision on the basis of making an evaluation of the different alternatives in a holistic way, and that includes all their implications and necessary elements during the product life cycle or the service life cycle.

It is important that the leader of the supply process involves all the necessary parties in order to collaborate and consider all the possible elements, to be able to close the best business possible for the company, saving costs during the process, which also means increasing the profitability of the organization.

References:

- The Supply Chain Cost Management: The Aim Process for Achieving Extraordinary Results: A handbook for Dramatic Improvement Using SCOR Model. Jimmy ANKLESARIA

- https://www.purchasing-procurement-center.com

About the Author

Oscar Mauricio Cendales Fetecua is an Industrial Engineer from Escuela Colombiana de Ingeniería “Julio Garavito”, with a Master in Finance from the University of Alcalá de Henares.

Supply Chain and Finance Executive with 15 years of experience in financial, telecommunications and Business Process Outsourcing industries. Experience in strategic sourcing, procurement, category management, negotiation, contracting, supplier management, financial planning, project financial evaluation, treasury management, IFRS and US GAAP financial accounting, tax management and asset management.

I have worked in several global and local companies, generating optimization of expenses and savings through the implementation of methodologies and best practices used in world-class companies