Each year around 700 million TEUs are shipped across the world keeping global trade and businesses running and more than eighty percent of global goods trade volumes are carried by sea, with about a sixth of that volume in shipping containers.

The advent of containerization heralded a revolution in cargo handling techniques, the ramifications of which are still influencing maritime trade all over the world today.

Nearly all goods, bulk, and liquid as well as more obvious commodities, are capable of being transported by this method, whilst specialized containers and new fittings are frequently introduced to an already sophisticated market.

2020 will live long in the memory as a year that was overshadowed by a remorseless pandemic causing untold disruptions for the container, logistics and ports industry across the world.

The initial outbreak of the coronavirus brought a volume bloodbath to the container port sector in the first half of 2020, but as the world emerged from lockdown restrictions, the shipping industry began experiencing unprecedented disruptions again and again.

By mid-April, the shipping traffic jam, part of a broader gridlock in supply chains around the world amid disruptions from the coronavirus pandemic, started thinning while record cargo volumes were reported in the U.S. ports of Los Angeles and Long Beach which saw their busiest March on record, handling a combined 898,287 TEU’s.

The Suez Canal, one of the most important waterways in the world, was accidentally blocked by MV Ever Given between March 23rd and 29th 2021. The enormous impact of this incident caused millions of dollars in daily losses and additional problems to the already highly stressed and widely overstretched shipping and logistics industry. On June 23rd, an Egyptian court seized the ship and its 18.300 containers, after the Suez Canal Authority filed a 900 million compensation.

Fast moving forward into 2022 ongoing widespread congestions in ports, container shortages, and volatile shifts in demand for goods from Western economies causing freight rates to skyrocket ended up adding extreme pressure on the main cost drivers of the ocean side of the supply chains and beyond.

Supply Chain KPI Dashboard

In vital terms of speed, and cost of transportation between loading and discharging terminals, vessels have become bigger and bigger which again adds additional pressure to the whole logistics ecosystem.

A good way to understand longer end-to-end transit times which under the current scenario have increased dramatically on most of the major trade lanes is to take a closer look at where delays are more likely to happen. For several reasons, this usually happens at the port terminals since ports are designed and built to have a certain cargo throughput capacity that cannot be re-adjusted easily, while also depending on other external factors like the labor workforce availability and ultimately the overall hinterland capacity ashore.

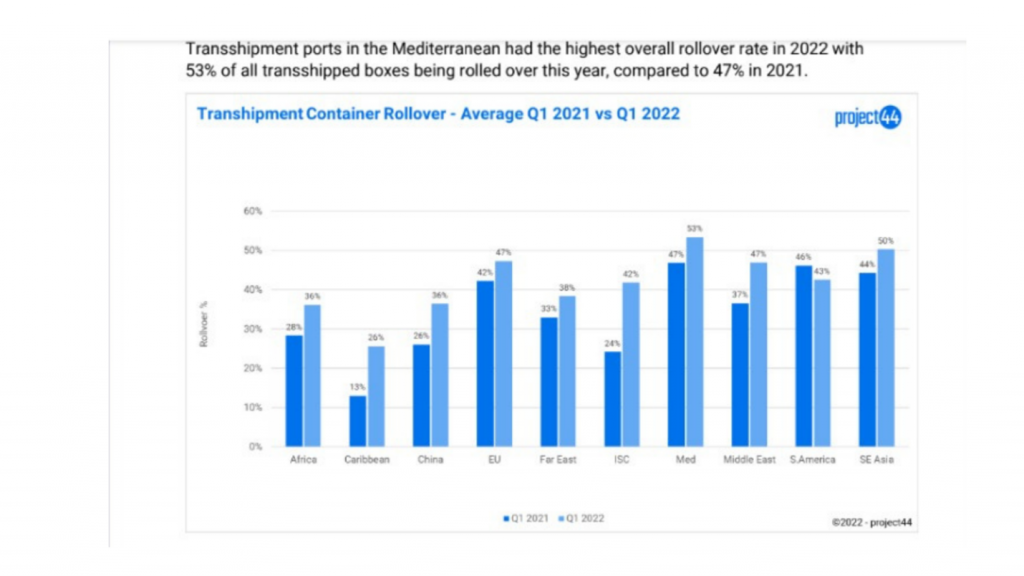

Another factor that has had an unparalleled spike, is the container rollover ratio that has reached soaring increment variations.

Complications throughout the system have affected transshipment operations with increased rollovers because of blank sailings heavily impacting global transshipment ports in 2022 when compared to 2021.

Shanghai is the most affected Asian transshipment port with a 57% rollover rate due to restricted port operations and COVID lockdowns in March. In total, rollover rates in transshipment ports were up across every region except for South America, one of the smallest for global and regional transshipment activities.

Transshipment rollovers in South America declined by 3% from 46% to 43% year-on-year. Every other region experienced sharp increases in the number of boxes being rolled over year on-year. The hardest hit by the increase in rollovers were the Indian subcontinent and China.

The rollover rate in the Indian subcontinent was up from 24% in 2021 to 42% in 2022, whereas the rollover rate in China reached 36% in 2022, compared to 26% last year.

Transshipment ports in the Mediterranean had the highest overall rollover rate in 2022 with 53% of all transshipped boxes being rolled over this year, compared to 47% in 2021.

Source: project44 Monthly report

Container rollover refers to when your container fails to get loaded onto its scheduled vessel and is accommodated by the carrier on a subsequent ship.

There are numerous reasons why containers get rolled, including but not limited to overbooking of cargo by the shipping lines, weight, and stowage plan restrictions, non-show of cargo, or blank sailings which again add difficulties to the already widely stressed and overstretched operational logistics.

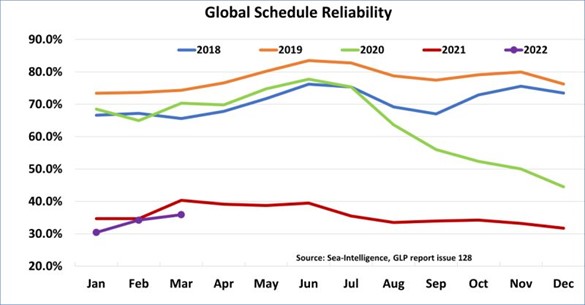

Sea-Intelligence’s Global Liner Performance (GLP) report, continues to slowly creep upwards, increasing to 35.9% in March, while the average delay for late vessel arrivals decreased once again to 7.26 days.

The overall outlook both in trade and the shipping industry, for the upcoming months, isn’t quite predictable now as disruptions continue and are expected to last through Q2 and Q3 2022 at least, if not fall way into 2023.

To combat runaway inflation, which reached 7.9% in February 2022 – the highest rate in 40 years – the US Federal Reserve raised interest rates by one-quarter point in March and trimmed its growth outlook for 2022 to 2.8% from 4%.

The prospect of further interest rate increases is highly likely if inflationary pressures persist. This coupled with rising geopolitical tensions driven by the Russia / Ukraine conflict as well as China’s ongoing COVID challenges are expected to create further shortages of commodities and goods, leading to further price increases and disruptions to the supply networks.

If ports, shipping lines, and freight forwarders around the world want to ensure resiliency in their operations and avoid disruptions and delays, they will need to embrace new strategies and the use of new technologies like real-time visibility that can assist in providing prompt forecasting of global trade volumes and insights into the movement of global freight.

The extreme need to traverse these nuances has propelled logistics companies to develop new solutions and expand services. Digital transformation through the adoption of AI innovations has been necessary to ensure meeting the overall upward trend in both demand and expenses in the supply chain.

An AI optimization model which considers all costs that occur during the container lifecycle is needed. Data analytics can provide visibility on the historical performance, health of current operations, and future costs based on predicted trends—telling companies whether or not a container should be express shipped or has time to wait in the port.

This allows companies to employ methods that include moving empty containers back to high demand locations just in time of need and furthermore saves on storage costs while mitigating empty stock imbalances at sites. With AI in forecasting, not only is the number of full containers clearer, but an estimation of available empty containers is also procured.

In a very tight freight market, like the current one with shippers fighting with shippers over scarce resources, what shippers need to ask themselves is how much would it cost not to ship and lose sales and therefore market share or worse, clients!

As a closing thought, embrace Change Management, the investment in new real-time visibility technologies, and promote leadership within your organization as teamwork has become of paramount importance in any kind of industry.

Bio

“Matias Guarello Wilhelmy holds a degree from the Chilean and German Commerce Institute and from the Cambridge Academy of Transport in Maritime Transport and a Diploma in Business Administration from the Adolfo Ibáñez university.

He is a trilingual executive with 30 years of a professional career in important companies in the shipping, export, and retail industries with ample experience in Operational and Commercial areas, having led in Chile, North America, and Europe, the design and implementation of integrated added-value solutions in the areas of Supply Chain and Sales Management.

He works as a Consultant and Business Development partner helping technology Startups in the field of Supply Chain and Logistics introduce their SaaS solutions in Latin America and Iberia.

Ever since he was a kid, he has been fascinated by ships, the oceans, and how this pretty much relates to every aspect of the world’s history and economy.

Coming from a family with a strong maritime legacy, growing up by the ocean was a gift and a great opportunity to learn sailing, which in time turned out to be not only a passion but a sport that shaped his character in many ways and one of the reasons why he choose Maritime Transport and Logistics as his professional path.

Some of the companies he has collaborated with and worked for are Transmetrics AD, Robotto Co., Arviem AG, Culinary Foods SpA, Falabella Retail S.A., Infineon Technologies A.G, Import Consultants OHG, Southern Food Trading Ltda., Atlas Exportaciones e Importaciones S.A., J. Lauritzen Chile S.A. and, Ultramar Agencia Marítima Ltda. among others”