Gather the accountants, leaders, department heads, store managers, and ask them which document plays the most significant role in the company.

Sure, you’ll get different answers.

But most will agree that one document is crucial for nearly all business functions, and automating it can ultimately boost your profits. And that’s no other than a purchase order.

It’s hard to ignore how important Purchase Orders (POs) are to growing retail businesses. From tracking orders to managing inventory to managing cash flows and increasing sales, POs play a pivotal role in enhancing daily operations.

Boston Consulting Group estimates that by using a PO, a company can reduce costs by 10% and at the same time cut the time spent by up to 30%.

But what exactly is a purchase order, and why do CPAs need one?

This post will explain what PO is and how it differs from an invoice. We’ll also look into the many benefits you can get by using a purchase order system. Let’s dive in!

Also Read –Top 16 Procurement KPIs – The Ultimate Guide

What Is a Purchase Order?

A purchase order—also known as PO, purchase requisition, or purchase request is a legal document created to ensure your business with vendors or contractors goes smoothly.

A PO is issued by a business’s purchasing department when placing an order with its vendors or suppliers. The document indicates the details of the goods to be purchased, such as the type of the goods, quantity of the items, agreed-upon price, and payment terms.

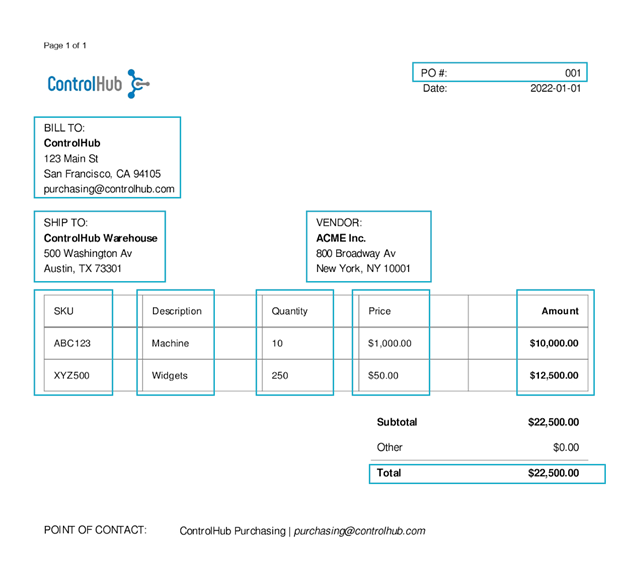

Typically, a purchase order will contain the following elements.

- Name of the vendor/supplier

- Purchase order number

- Purchase order date

- Buyer’s contact information

- Description of the goods ordered

- Agreed upon price

- Payment information

In most cases, when the vendor accepts a PO, it becomes legally binding. In short, they’ve entered into a contract and are now bound to deliver the goods.

Why Does a CPA (Certified Public Accountant) Need Purchase Orders?

A purchase requisition is one of the most important documents to a CPA. Here’s why.

Makes Orders Easier to Track – Purchase orders are an important part of record keeping.

Utilizing a PO system makes it easy for accountants (and business owners) to track orders. Plus, you can quickly check whether you’ve received the correct items and in the right quantity and quality when your order arrives.

It Provides Legal Protection – A PO acts as a legal document.

Having a legal written agreement regarding the items you ordered, including the pricing and quantity info, can help protect the buyer and the seller.

This way, POs protect you by giving you a legal, enforceable record of precisely what you ordered. It can also guard your company against unjustifiable price increases.

In the event you receive the wrong items or are charged the wrong amount, the PO can help you resolve the issue. In other words, a PO helps resolve potential problems before they damage your relationship with the vendor.

Helps Avoid Audit Problems

CPAs can benefit a lot from using POs. These documents help them avoid audit problems by providing proof of purchase.

Purchase orders provide auditors with a conclusive audit trail and an easy way to cross-check invoices and packing slips, thus simplifying the auditing process.

Without POs, accountants and business owners would have to go through a painful process of poring over invoices, emails, and receipts from vendors.

Makes Life Easier for Your Vendors

Setting up a PO system gives you the tools needed to keep track of your vendors.

You’ll be able to store and sort information about your suppliers and set up policies about which items should be purchased from each vendor—which can help you save time.

Most importantly, having a PO system can expedite the ordering process.

If your vendors are used to receiving POs, you’ll get your shipment faster by sending them one. With everything they need to know in one place, the purchasing process becomes straightforward—there will be no back and forth and no miscommunication.

How to Create a Purchase Order

Creating a PO will usually be conducted over a digital system, which automatically generates most of the purchase order information.

Typically, a PO needs to contain the following components.

- PO Number – a unique number that allows the buyer and the vendor to easily find and log the PO

- Header – This section contains the basic information about your company (name, location, address, contact, and website)

- Vendor Data – This section contains the seller’s information, including their name, address, location, name of the rep you’re working with, etc.

- Billing & Shipping Addresses – This section specifies where the order will be shipped.

- Order Details – Lists the items ordered, including the product code, item name, quantity, price, and delivery date.

- Pricing – A subtotal cost for all the ordered items, including discounts applied, taxes, shipping costs, and the total cost of the order.

Here’s what your PO should look like.

Image Source: ControlHub

Impact of POs on Monthly Bookkeeping Tasks

As a small business owner, your monthly bookkeeping tasks may include:

- Performing bank reconciliation

- Preparing and sending out invoices

- Paying vendors and other bills

- Reviewing outstanding invoices

- Reviewing your financial standing

Implementing a purchase order system can provide transparency in the procurement docket and help you track your orders and expenses.

For instance, a robust PO system will keep all your purchasing information in a central place, making it easy to track where the money is going.

This can come in handy, especially when performing bank reconciliations, as you’ll have a clear picture of what has been paid out and to who. It can also help you quickly review outstanding invoices and know when to follow up.

Plus, a PO also helps accountants and business owners track encumbrances.

Depending on the items ordered and the vendor you ordered from, there can be a long lead time between the time you order and the time you receive the goods.

Even though the goods are not in your warehouse, you’re still responsible for the costs associated with those goods. Without a PO, these costs are usually invisible to an organization and can lead to inaccurate reporting and auditing issues.

By using a PO, you can track these encumbrances and perform proper bookkeeping taking goods in transit into account.

How Is a Purchase Order Different from an Invoice?

If you’ve never used a PO before, you might be wondering how it differs from an invoice. Well, to start, different team members create these documents.

A PO is generated by the buyer for the purpose of ordering goods from the supplier. It’s a request sent to a vendor detailing exactly what is expected to be delivered.

The invoice, on the other hand, is generated by the supplier and shows how much money the buyer needs to pay for the goods delivered. The PO is a contract of the sale, while an invoice is a confirmation of a sale

How are Purchase Orders Different from Sales Orders

While a PO refers to an outgoing order for the purchase of goods or services, a sales order is prepared and sent by the vendor to confirm that the order has been received.

Upon receiving a PO, the vendor creates a sales order detailing the information necessary for delivery, including item price, quantity, delivery date, payment arrangement, etc.

To Sum It Up

A PO is a document sent from a buyer to a vendor, indicating types, quantity, and agreed prices for products or services. This document can go a long way in clearing any misunderstanding between the buyer and the seller.

Additionally, since a PO is a legal document, it can provide legal protection to both the buyer and the seller. Accountants and CPAs will also find it very useful as it helps avoid audit problems while making it easier to track orders.

References

About the Author- Dr Muddassir Ahmed

Dr MuddassirAhmed is the Founder & CEO of SCMDOJO. He is a global speaker, vlogger and supply chain industry expert with 17 years of experience in the Manufacturing Industry in the UK, Europe, the Middle East and South East Asia in various Supply Chain leadership roles. Dr. Muddassir has received a PhD in Management Science from Lancaster University Management School. Muddassir is a Six Sigma black belt and founded the leading supply chain platform SCMDOJO to enable supply chain professionals and teams to thrive by providing best-in-class knowledge content, tools and access to experts.

You can follow him on LinkedIn, Facebook, Twitter or Instagram