Supplier Segmentation for supply base implies categorizing suppliers through analysis and prioritization process solely to allocate suitable resources, and manage and monitor them. Unfortunately, no one supplier segmentation applies to every business model. Complex segmentation requires multidimensional matrices to address all associated peculiarities and risk factors.

So, What is the Supplier Segmentation Matrix?

The supplier segmentation matrix is created majorly for activities like sourcing negotiations and supply base rationalization. Typical segmentation exercises help define “how dependent your business operation is on a particular supplier(s)?” or “how costly or difficult it is to switch suppliers?”.

Nevertheless, several other considerations like competition, performance potential, market factors, and other references can add to segmentation challenges. Getting familiar with these attributes or characteristics of critical suppliers can be attained while working with them. A typical approach is examining the supply base by “spend” and “risk.”

- The spend factor entails more concentration on critical suppliers to your business process and on whom you are willing to spend time and resources.

- The risk factor entails the degree of exposure your business has to supplier performance failures—for example, late deliveries, service failures, warranty problems, quality defects, etc.

While some risks are shared, every business faces specific types of threats regarding suppliers. Concerning risk, identifying vital supplier risk factors that can unfavourably affect your business process can be used for performance evaluations and in creating practical preventive actions.

The basic idea of a supplier segmentation matrix is the identification of all suppliers to be considered strategic or critical to the business.

“Strategic supplier delivers a product or service which adds value to a business, and if they fail, it impacts the customers, infrastructure, and operations.”1

“Critical supplier delivers a product or service to a business such that if poorly done, either leads to no business operation or unhappiness amongst customers.” 1

Suppliers can be critical and strategic, as they are not mutually exclusive. Segmentation matrices are mainly helpful to initiate a thorough process and discussion within an organization to recognize relevant suppliers who deserve more attention, work, and close monitoring rather than as a scientific undertaking.

Below are 3 Types of Supplier Segmentation Matrix You Can Use to Classify Suppliers

1) Kraljic’s Classic Supplier Segmentation Model

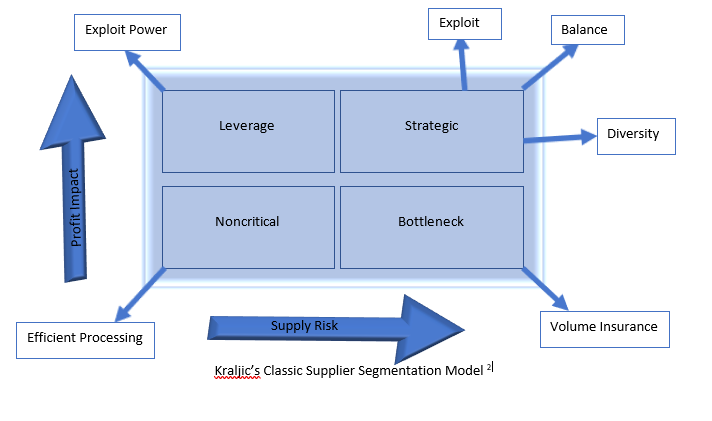

Kraljic’s portfolio model is a classic supplier segmentation model whose main goals are to identify the strategic weight of strategic suppliers, both externally and internally, to aid in adapting your business strategies.2

The Kraljic’s Classic Supplier Segmentation matrix aims to guide businesses facing economic, environmental, and technological transformation. 2

- As earlier highlighted, strategic suppliers are vital to attaining high impact and value concerning customer’s business and achieving long-term goals. For instance, strategic suppliers can deliver industry expertise, exceed contractual expectations, and actively manage costs—any supplier considered a strategic supplier is a prime candidate for performance evaluation.

- The term “leverage supplier,” also called collaborative suppliers, implies leveraging purchase volumes with suppliers who can financially impact a business by focusing on overall ownership cost and decent profit margins.

- Bottleneck suppliers, also called custom suppliers, are not strategic but provide supplies that have a high dependence on the customers. Thus, such suppliers can generate a supply bottleneck if there is a supply failure or problem. They also present a potential risk of supply interruption, which is an essential factor in performance monitoring.

- Noncritical or commodity suppliers are the easiest to replace as their products and services are not considered critical or high risk to the business process. They also require less attention other than focus on operational efficiency when engaged in a deal.

The difficulty with Kraljic’s Classic Supplier Segmentation matrix is that the terms are imprecise, i.e., categorising suppliers is hard. Also, no guidelines help quantify factors like risk and profit impact. The time spent in defining and quantifying these concepts may not be worthwhile, especially when segmenting for performance measurement and monitoring.

Regarding supplier management and development, showing multiple dimensions using one matrix is impossible. In this case, the matrices segment suppliers, according to categories of importance. For instance, the matrix covers suppliers’ level of commitment and specific strategic plans for building customer relationships.

For example, suppliers’ level of commitment to the customer (in Table 1) analyses which suppliers are committed to customers and value. A committed relationship, open communications, and trust help reduce risk.

Table 1. Supplier Commitment Matrix

| Low Commitment | High Commitment | |

| Low Actual Commitment | Maintain | Plan for Improvement |

| High Actual Commitment | Caution | Maintain |

The supplier characterization matrix (Table 2) covers the characterizing suppliers based on product development. It exclusively covers how suppliers can contribute to improving the product and potential redesign options.

Table 2. Supplier characterization matrix

| Low Spend | High Spend | |

| High Design Input | The target for a redesign of the standard item | Savings through design Input |

| Low Design Input | Caution | Maintain |

Another supplier characterization matrix (for spending, Table 3) characterizes attention needed for spend and risk. More care is required in the supplier category when the risk is high and the spending is low. In the case of high expenditure, there’s a need for a relationship/partnership. Low-risk, high-spend suppliers entail less focus on the relationship and more on contract terms, as it is usually not worth it.

Table 3. Supplier characterization matrix (spend)

| Low Commitment | High Spend | |

| High Risk | Special attention | Partnership |

| Low Risk | Transaction | Contract |

2) Segmentation for Supplier Performance Management Actions

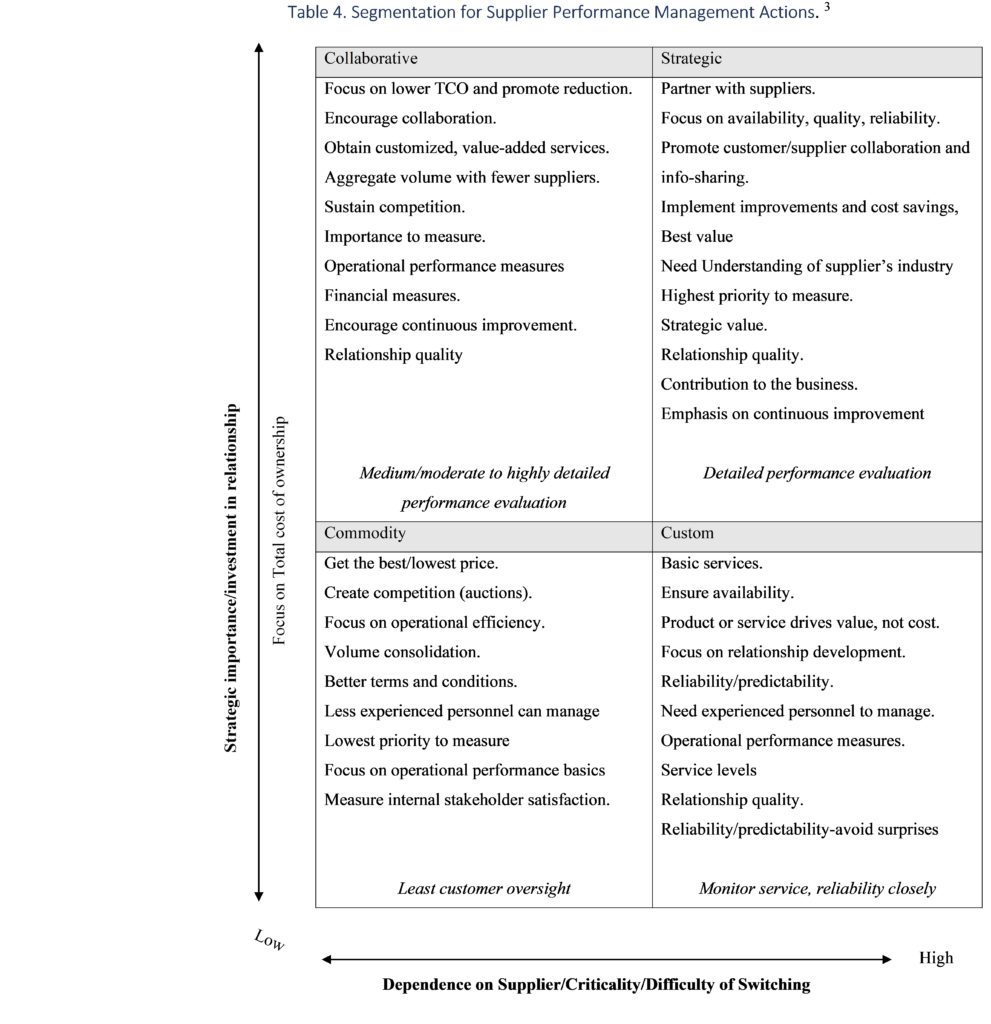

For performance management, businesses are expected to address the number of resources and time to invest in the development and management of supplier relationships alongside the procurement expertise level.

Table 4: Segmentation for Supplier Performance Management Actions

The supplier management matrix (in Table 4) incorporates multiple dimensions like an investment in the relationship, strategic importance, focus on Total Cost of Ownership (TCO) set against dependence on the Supplier, criticality of the Supplier, and switching difficulty. These actions vary in the type of Supplier you choose.

The supplier segmentation matrix above also delivers general guidelines on supplier performance management and measurement for collaborative, commodity, custom, and strategic supplier segments. This supplier segmentation matrix also addresses the experience level required by supply management personnel.

In Segmentation for Supplier Performance Management Actions, “custom” and “strategic” suppliers in any business operation often hold the highest risk and require monitoring. Nevertheless, “custom” suppliers’ performance requires tracking because they are critical to the business. Also, they are not classified as cost reduction prospects, as they generally involve less detailed performance monitoring and measurement.

Investment in relationships and more accurate evaluations are vital for “collaborative” and “strategic” suppliers. It entails more specific industry expertise in managing strategic suppliers and less overall experience for commodity suppliers. The custom supplier requires more experienced personnel to control its performance, as faults can lead to a total business shutdown.

- The emphasis on strategic suppliers is highlighted through vital values, relationship values, and contributions to business growth.

- Continuous improvement is also essential for collaborative suppliers as they have a financial and operational impact on the business. The use of performance measures for financial and operational roles is considered vital.

- Custom suppliers offer continuity of supply with service levels and operational performance measures deemed applicable.

- Commodity suppliers feature the lowest impact on business operations but can sometimes affect internal customer satisfaction.

For performance measures, the focus is typically on operational performance basics. For relationships with more strategic and partner-like connections between business and suppliers, the more supplier performance hinges on non-contractible areas.

3) Supplier Segmentation Based on Relationship & Potential

This supplier segmentation matrix segments the supplier base to establish a suitable engagement level for suppliers. The level definition helps in resource allocation required to sustain the business process. The stories highlighted in the Supplier Segmentation Based on Relationship and Potential include Preferred (Strategic), Develop/Emerging, Maintain, Directed Suppliers, and Eliminate/Exit.

Additionally, the business requirements and Segmentation vital to this category strategy are further explained using the different headings (Definition, Benefits, Prerequisite Guidelines, and Supplier Criteria (Ideals)) in Table 5.

The Supplier Development Framework

Table 5. Supplier Segmentation Based on Relationship & Potential

| Preferred (Strategic) | Develop / Emerging | Maintain | Directed Suppliers | Eliminate / Exit | ||

|

Definition

|

A supplier that has demonstrated strong and consistent performance for at least 24 months and has the potential to grow in line with business needs. | A supplier that has been evaluated for a unique value proposition (technical, cost, or supply improvement opportunities) | Legacy suppliers with an acceptable level of performance. Resourcing may be prohibitive due to tooling or other issues. Not strong enough to be considered for future business

|

A supplier that has been ‘prescribed’ to us to use from a customer.

The customer negotiates spending with such suppliers; therefore, you may have no leverage. |

A supplier that does not maintain an acceptable level of performance lacks the required capabilities. Action is underway to remove all business from the Supplier as soon as possible for |

|

|

Benefits |

..to Supplier |

|

|

|||

| ..to Buying Company |

|

|

||||

|

Prerequisite Guidelines |

Before achieving the ‘Preferred’ classification

|

Before achieving the ‘Develop/ Emerging’ classification

|

|

|

||

Supplier Segmentation Challenges

As we learn Supplier Segmentation offers numerous advantages, it also presents several challenges:

1. Data Availability and Quality: Acquiring accurate and up-to-date supplier data can be arduous. Many organizations encounter difficulties due to incomplete or inconsistent supplier information, which hampers effective supplier segmentation.

2. Defining Relevant Criteria: Determining the criteria for segmentation can be intricate. Organizations must ascertain the most pertinent factors for their specific requirements, whether it pertains to expenditure, performance, risk, or other considerations.

3. Data Analysis and Interpretation: Analyzing supplier data and extracting meaningful insights can be demanding, particularly when dealing with extensive datasets. Organizations may lack the necessary analytical tools and expertise to conduct effective segmentation.

4. Subjectivity and Bias: Supplier segmentation can be influenced by subjectivity and bias. Human judgment can result in inconsistencies and inaccurate categorization, potentially impacting procurement decisions.

5. Dynamic Nature of Suppliers: Suppliers’ characteristics and performance can evolve over time. Maintaining an accurate and dynamic segmentation model necessitates continuous monitoring and updates.

6. Resistance to Change: Introducing supplier segmentation within an organization may encounter resistance from internal stakeholders who are accustomed to traditional supplier relationships and procurement processes.

7. Resource Constraints: Implementing and managing supplier segmentation requires resources, including skilled personnel, technology, and data management tools. Small- and medium-sized enterprises may face limitations in this regard.

8. Supplier Collaboration: Collaborating with suppliers to gather additional data or enhance performance can be challenging, particularly if there is resistance or a lack of willingness from suppliers to participate in the process.

Conclusion

Using the Supplier Segmentation Matrix is an essential step in designing and implementing a robust business operation. The types highlighted above can find usefulness in most organizations having a wide range of attributes and priorities. With the aid of the Supplier Segmentation Matrix, businesses can identify key value drivers and define suitable engagement levels and frequency.

References:

- Bullington, Kimball, Ph.D., Supply Base Segmentation, Middle Tennesee State University, Smart Ideas, ISM Nashville

- Kraljic, P.,” Purchasing Must Become Supply Management,” Harvard Business Review, 1983, 61(5), p.111.

- Gordon, R. Sherry, 2008, Supplier Evaluation and Performance Excellence, J Ross Publishing, USA.

About the Author- Dr Muddassir Ahmed

Dr Muddassir Ahmed is the Founder & CEO of SCMDOJO. He is a global speaker, vlogger and supply chain industry expert with 17 years of experience in the Manufacturing Industry in the UK, Europe, the Middle East and South East Asia in various Supply Chain leadership roles. Dr. Muddassir has received a PhD in Management Science from Lancaster University Management School. Muddassir is a Six Sigma black belt and founded the leading supply chain platform SCMDOJO to enable supply chain professionals and teams to thrive by providing best-in-class knowledge content, tools and access to experts.

You can follow him on LinkedIn, Facebook, Twitter or Instagram